Page 24 - inPRINT Issue 63

P. 24

inFACT

OUTPUT AND ORDERS SINK TO NEW

printing outlook DEPTHS IN Q2 AMIDST COVID

ENFORCED CRISIS IN CONFIDENCE –

BUT REBUILDING IS UNDERWAY IN Q3

he UK printing and forecast (-55). This is the competitors pricing below a section on the COVID-19

Tprinted packaging worst quarterly report on normal rates (24%). restart. The standout issue

industry hit a record low in record, undercutting the -51 The notable changes in preventing full recovery from

the second quarter of 2020. recorded in Q1 2009 and the the priorities are a decline in the enforced slowdown is

The COVID-19 outbreak hit immediate aftermath of the concern regarding the health insufficient demand levels

at the end of Q1, but it is Q2 financial crisis. & safety aspects of COVID-19, to sustain business. A ‘lack

that has taken the brunt of The output balance of -59 an increase in concerns of demand’ was by far the

the impact as both output was just below the forecast of about ‘competitors pricing most commonly selected

and orders recorded their -55 for Q2. A balance of +7 is below cost’ (from 13% to operational challenge, chosen

worst ever balances – in line forecast for Q3. 24%) and Brexit coming back by 70% of respondents.

with the forecasts provided During Q3, output growth on the radar (up from 6% The action businesses

in Q1. But expectations for Q3 is forecast to increase for last quarter to 27% on this would most like to see

reveal some improvement is 36% of companies. A similar occasion). Government take is an

to come, though certainly not proportion (35%) predict The latest edition of extension of the Coronavirus

a return to pre-coronavirus that they will be able to hold Printing Outlook also features Job Retention Scheme (CJRS);

normality. output levels steady, but

The latest Printing Outlook 29% expect output levels to Top 3 business concerns – % of respondents selecting

survey shows that 15% of fall. That leaves a forecasted 0 20 40 60 80

printers managed to increase balance of +7 for the volume Late payment by customers 35

their output levels in the of output in Q3. Survival of major customers 37

second quarter of 2020. Dealing with the economic Competitors pricing below cost 24

Fewer (11%) were able to impact of COVID-19 remains, Paper or board prices

hold output steady, whilst by far, the most important 10

74% reported a decline in business concern for Pre-pack administrations 10

output. The resulting balance businesses. It was selected Weak productivity levels 11

(the difference between the by 75% of respondents. The Profit levels insufficient to ensure… 7

ups and the downs) was top three concerns were Brexit 27

-59, a further drop from survival of major customers’ Covid-19 - health and safety 17

the -43 reported in Q1 and (37%) late payment by Covid-19 - economic impact 75

marginally below the Q2 customers (35%), and

Source: BPIF Printing Outlook

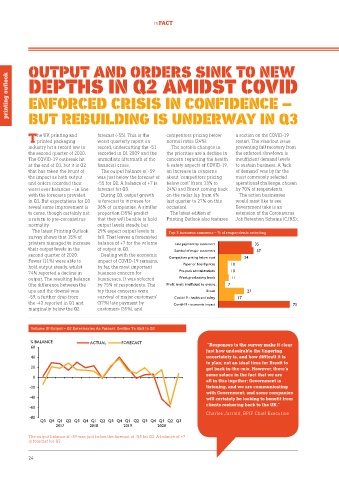

Volume Of Output – Q2 Deteriorates As Forcast, Decline To Halt In Q3

% BALANCE ACTUAL FORECAST

60 “Responses to the survey make it clear

just how undesirable the lingering

40 uncertainty is, and how difficult it is

to plan; not an ideal time for Brexit to

20 get back in-the-mix. However, there’s

some solace in the fact that we are

0

all in this together; Government is

-20 listening, and we are communicating

with Government; and some companies

-40 will certainly be looking to benefit from

clients reshoring back to the UK.”

-60

Charles Jarrold, BPIF Chief Executive

-80

Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2017 2018 2019 2020

Source: BPIF Printing Outlook

The output balance of -59 was just below the forecast of -55 for Q2. A balance of +7

is forecast for Q3.

24